This article was originally published in Maclean's Magazine on September 8, 2003

Canadian Stones Transform Diamond Industry

WAWA, ONT., is a town known to cross-country hitchhikers as a cursed spot. They say you can be marooned here for days, dusty and morose on the side of the TransCanada, waiting for a lift. The town itself is a little like that, too - in need of a lift - and has been ever since 1998, when the nearby Helen iron ore mines closed down after 60 years of production. Recently the sign on the way into town was updated: the population is 3,700 now, down from 4,500.

Yet in the bush not far to the north, something promising - at least potentially - is taking place. Alan Shefsky, a hefty man with fingernails chewed to the quick, is watching as a mechanical shovel clears out undergrowth to expose a massive rock bigger than a Wawa bungalow. One worker mans a hose, washing away leftover dirt. Another cuts into an already exposed patch of the lumpy and speckled rock with a circular saw that screams and sends off plumes of smoke. In a moment, he'll chisel out a hunk of rock the size of a mini chocolate bar. This is old-time PROSPECTING: Shefsky's looking for DIAMONDS. In fact, this president of a small exploration company already knows the precious stones are in these rocks. He has one small vial containing a little gem, three-quarters of a carat in size, and another vial with many tiny ones. Are there enough, and are they big enough, to make it worthwhile to develop a mine? He's hopeful. The snack-sized sample he's just taken is from a bump on the boulder. "It's possible that's from the part of the Earth's mantle where the big diamonds are," Shefsky says. "That's the key."

Exploration activity like Shefsky's has been going on almost everywhere in Canada ever since an eccentric and dogged prospector named Chuck Fipke discovered diamond deposits north of YELLOWKNIFE in the early 1990s. Hundreds of exploration companies have been combing Canada's wilds for the gems - as elusive as they are coveted - and with some fabulous successes. Two mines in the Northwest Territories, one that opened just this year, are producing some of the best-quality diamonds ever seen. As new mines are developed in the next few years, Canada will overtake South Africa as the world's third most important producer, after Botswana and Russia.

Although Canada is a newcomer in the exclusive club of diamond producers, its entry into the business has been explosive, forcing new ideas and new ways of doing business on an industry long entrenched in an old-style way of operating. Some Canadian discoveries, including Shefsky's, are challenging the geological wisdom about where diamonds reside. And in a marketplace increasingly worried about blood diamonds - called that because, amid reports of slave labour and torture, they have helped finance horrific civil wars in countries such as Angola, Democratic Republic of the Congo and Sierra Leone - Canadian gems have the additional cachet of being conflict-free. Producers here are initiating the concept of branded gems - stones with a minuscule symbol like the maple leaf implanted on an edge - and are charging a premium for them.

But most importantly, Canada has challenged South Africa-based De Beers Group, the multi-tentacled, one-time monopoly player. Russian diamond dealers have already chipped away at the De Beers cartel, but with little impact on the way the game is played. Canadian operators, however, are forcing the world's single most dominant diamond company to play by new rules that could ultimately change the way the business is conducted all around the world.

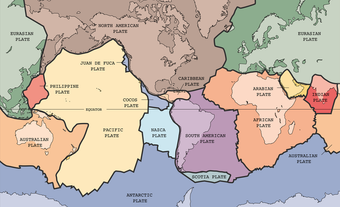

THE MYSTIQUE about diamonds isn't just about the entrancing, magical dance of light they emit, and it's not just the imaginations of brides-to-be that are captured by their unmatchable sparkle. The gems, once exclusively the jewels of kings and queens, started out billions of years ago as pure carbon in the mantle more than 150 km below the Earth's surface. The immense pressure and heat of the mantle crystallized the carbon into a unique chemical structure, forming the hardest known substance (not to mention the basis for that remarkably durable slogan, diamonds are forever). When molten liquid called kimberlite magma travelled through the mantle, it, like a bus picking up passengers, brought the gems closer to the Earth's surface. From a few kilometres below the surface, the magma then erupted, spewing lava, rocks and particles into the air. Underground, it solidified, embedded with diamonds, into what's called a kimberlite pipe. Not all pipes hold the precious stones. Geologists love this stuff.

"It's no surprise there are diamonds in Canada," says Roger Mitchell, one of the world's leading experts on kimberlites and a professor at Lakehead University in Thunder Bay, Ont. Diamond-bearing kimberlites only occur in the parts of the world, he explains, where there are cratons - old rocks that lie undisturbed for billions of years. While much of it is covered in trees or ice or swamps, the Canadian Shield, which covers almost half of Canada's land mass, contains the world's largest craton. The world's largest kimberlite has been found in Canada, too. It's in Saskatchewan, and just one pipe spans 242 hectares. In comparison, the first pipe at the Ekati mine in N.W.T., a kimberlite full of magnificent diamonds, covers 3.56 hectares.

Currently, the most successful players in Canada are two foreign firms. BHP Billiton Ltd., of Australia, opened Ekati, Canada's first diamond mine, in 1998, after striking a deal with prospector Fipke. Rio Tinto plc of London, England is the majority owner of Diavik, a mine that opened just this year, 35 km southeast of Ekati. Perhaps because it missed out on those two plays, but also in recognition of the significance of Canada on the world scene, De Beers - which has quietly been exploring here for 30 years - has ramped up its budget for Canadian exploration. Last year, 45 per cent of the diamond giant's global exploration budget was spent in Canada, says Richard Molyneux, president and CEO of De Beers Canada Corp. Right now, the company is involved in 30 different projects, some of them solo, others as joint ventures. "A lot are in the early stages and a lot will fall by the wayside," he says.

Molyneux expects De Beers will be operating three or four Canadian mines in the foreseeable future. Two are close to being operational: the Snap Lake project, located not far from Ekati and Diavik, and the Victor mine, a site in northern Ontario on the shore of James Bay, could be in full production by 2007. "We are very committed to Canada," states Molyneux, a South African and De Beers lifer who moved to Toronto in 1999 to manage the company's Canadian affairs. And, as a little reminder, with just a hint of the power behind the De Beers name, he adds: "Diamonds are our business."

For decades, De Beers controlled the world's supply of rough diamonds. Only De Beers' select list of buyers could trade the gems, and if buyers went outside the cartel, they were cut off. While De Beers still has its coterie of buyers, its ironclad grip on the market is weakening - largely because of the influx of Canadian stones - and the work of one-time BHP executive Bill Zimmerman. Before the Ekati mine was built, Zimmerman spent three years travelling the world to establish a market for rough diamonds that didn't rely on De Beers.

The effort wasn't simply designed to outflank the monopoly. BHP, which operates mines in the United States, feared it could have contravened U.S. anti-trust laws had it dealt exclusively with De Beers in the diamond market. "We demonstrated that the company could sell diamonds outside the De Beers system and be a success," says the now retired Zimmerman. "Prior to that, the perception was you couldn't do it." Initially BHP sold 35 per cent of its rough Ekati rocks to De Beers. Today it sells none to the diamond giant. Jim Excell, president and COO of Ekati Diamond Mine, downplays the level of competition between the two mining behemoths. "The marketing group has done well enough," Excell says. "Our focus is on the customer."

Diavik, too, established some new rules. The site was discovered by Eira Thomas of a small junior exploration company then known as Aber Resources Ltd. Back in 1994, the then-24-year-old geologist - a woman with the looks of a model - completely wowed the diamond world with what she'd found. Under Lac de Gras, her team discovered the highest-grade cluster of diamond-bearing kimberlites in the world. Then she went on to continue to impress that world: in negotiating the deal with Rio Tinto, a multinational mining company brought in to finance Diavik, Aber managed to hold on to an unprecedented 40 per cent of its diamonds, in perpetuity. In a conventional deal, a junior exploration company might tap into a mine's revenue stream, but not the actual product. Thomas's deal with Rio Tinto not only made her extremely wealthy, it catapulted Aber - now known as Aber Diamond Corp. - into the industry's big leagues. Aber then made a deal to sell its stones to jewellery giant Tiffany's, completely bypassing the De Beers middlemen and further draining power away from the cartel.

Thomas, today an Aber director and CEO of a new resource company, Stornoway Ventures Ltd., is again searching for more diamonds. Stornoway has hooked up with other exploration companies and controls over 4.5 million hectares of potential diamond properties across the North. "That's our strategy: spread the risk and get involved in as many quality projects as possible," she says. The world has changed for junior exploration companies, she says. A decade ago, exploring for diamonds was considered too risky for a small venture. While investors are still skeptical - in large part a hangover of the Bre-X Mineral Ltd. gold-salting fiasco of 1997 - investors are warming to exploration companies such as the ones she's associated with. Aber, once a penny stock, is today the world's largest publicly traded diamond company, its shares currently selling for roughly $32.

Al Shefsky hopes his firm, Pele Mountain Resources Inc., will follow a similar path. It holds the mineral rights to 10,000 hectares of land and trades near 40 cents on the TSX Venture Exchange. After a long, 16-month stretch of negotiations, Shefsky struck a deal in July with a major mining company to work toward developing a mine. The partner? De Beers. But Shefsky tore a page from Thomas's game plan and insisted that Pele Mountain, if it contributes a 45-per-cent share toward the mining costs, will keep that same share of the diamonds that are recovered. It's one of the first times De Beers has relinquished control over the rocks that will come out of a mine it intends to operate.

Shefsky has only nice things to say about his new partners. "They are there. They are moving fast. They want to do it right," he says. Shefsky's team, essentially a local prospector/geologist and a mining consultant named Ed Walker, have identified more than 20 sites - called occurrences - on the Pele tract of land near Wawa where they believe diamonds are plentiful (other companies are exploring adjacent properties for diamonds). At this one spot, named Mumm - most of the Pele occurrences are named after good champagnes - the rock is, at 2.7 billion years, much older than the kimberlite where diamonds normally are found. And it presents earth scientists with a new riddle.

For De Beers, that in itself is a big reason to invest with Shefsky in the Wawa site. "These are not your typical kimberlite bodies," says Molyneux. "Unravelling what it is we are dealing with is sufficient motivation for the investment." De Beers has also entered into a partnership with another small Canadian company, Kensington Resources Ltd., to explore Saskatchewan's intriguingly large kimberlite. But with both projects, Molyneux is reluctant to predict when, if ever, there will be an operating mine. The Saskatchewan site is buried under 100 m of glacial material, a "headache" that pushes up mining costs. At Wawa, bulk samples from at least three different spots will be carted away later this month to be tested. But it'll be a longer haul before it's known if the site is worth the cost of building a mine. Unlike most minerals - gold, for instance - there are huge differences in the quality of diamonds, and the prices they command.

Molyneux admits De Beers's role has changed. For a long time, he says, "we saw ourselves as the custodian." The company maintained a massive stockpile of diamonds as a means of maintaining a steady supply-demand balance. "We were the buffer that kept prices stable over a long period of time," he says. Now, De Beers seeks to remain the market leader. "We want to maintain our share of global production at 50 per cent," Molyneux says. That's a striking drop from De Beers's one-time 80-per-cent share of production. And it shows that, even if De Beers continues to dominate the world's diamond industry, Canada has changed the diamond business. Forever.

Robots with a keen eye for shape and colour

Uri Ariel places on the table a tidy package made of waxy-white paper folded into a rectangle the size of a small envelope. He gingerly opens it to reveal dozens of shiny rough diamonds. Worth $137,000, they range in size from one to 2.5 carats. "Pick one," he says.

Ariel, president and CEO of HRA Investments Ltd., operates the first diamond cutting and polishing operation of its kind in North America. Almost the entire global supply of diamonds is cut and polished by people hunched over thick magnifying glasses, many located in Third World countries. But here, in a 10- by 12-foot room on the 21st floor of a downtown Vancouver office tower, are more than two dozen appliances, each smaller than a home sewing machine. They are robots, programmed to cut and polish diamonds. "This," says Ariel, "is the future."

With slender silver-coloured tweezers, Ariel takes a gem and places it into a box attached to a desktop computer. An image of the diamond comes up on the screen with lines drawn into it, suggesting the optimum cut for this particular rock. Other choices, including cutting it in half to produce two smaller cut stones, are also offered. With the touch of a few keys, Ariel can program one of the robots behind him to cut the stone into a shape suitable for an engagement solitaire. In the space of an hour, the machine will do the work that would take a person a day, Ariel says. The machines were a heavy, $1-million, up-front expense, he adds, "but they don't get sick and don't need holidays. And they work seven days a week."

The decision to go high-tech in Vancouver was taken two years ago, when the Ekati mine near Yellowknife - Canada's first diamond mine - began producing gems. While Ekati right now is his main supplier, Ariel just struck a deal to be the largest core customer of Diavik Diamond Mines, Canada's second - and newest - diamond mine. The robots work only with N.W.T. stones. Ariel markets them with a Canadian brand, including a certificate for each stone that describe its weight, clarity, colour, type of cut and even the mine where it originated. Currently, N.W.T. gems represent less than 10 per cent of the global market, but that share is climbing and they are highly prized - they already sell for a 15- to 20-per-cent premium over other, non-branded stones. "Soon," Ariel predicts, "more consumers around the world will prefer Canadian diamonds."

See also: MINING

Maclean's September 8, 2003

Share on Facebook

Share on Facebook Share on X

Share on X Share by Email

Share by Email Share on Google Classroom

Share on Google Classroom