Customs and excise, taxes on goods, are one of the world's oldest sources of government revenue. Customs duties are applied on imported products while excise duties and taxes are generally applied on goods of domestic manufacture, notably liquor and tobacco. The word "customs" derives from custom, a habit. Customs and excise have played a vital role in Canada's development. They were at the centre of the dispute, especially in Nova Scotia, between Crown and legislature for the right to impose and dispose of customs duties; they were the key element in the National Policy, which endured for nearly a century; and they were central to the achievement of national independence through government use of tariff negotiations with other countries.

Customs duties were already here when the Europeans brought rum and religion to North America: some native tribes exacted tribute from members of other tribes passing through their territories. The French regime helped to support New France through an export duty on furs and did not rely on import duties until its dying years. The British did not use customs as much for revenue as for enforcement of their Navigation Acts, which required that British goods be carried in British ships. After Britain turned to free trade in the 1840s, customs and excise in Canada became almost exclusively a revenue producer until after Confederation.

When British North American representatives met in 1864, they discussed a "common commercial policy." Until then their only common policy had been for each to tax the manufactured goods of the others as readily as those of other nations. In 1867 responsibility for the tariff was given to the national government. The Province of Canada's Customs Act of 1866 was adopted, and in 1868 the average tariff was set at 15%, a compromise between protectionist Canada's 20% and free-trading Nova Scotia's and New Brunswick's 10-12%. A higher tariff to nourish and protect domestic manufacture was not introduced until 1879 under Prime Minister Sir John A. Macdonald. By 1883, annual revenue had risen to $23.2 million. Until WWI, when income and sales taxes were first imposed in Canada, customs and excise revenue comprised about 75% of the federal government's revenue.

In the Province of Canada (1841-67), customs was administered by the Finance Department Customs and Inland Revenue, established in 1867 as separate ministries, were united in 1918 and in 1921 became Customs and Excise. In 1925, income tax collection was moved from Finance to Customs and Excise, resulting in another name change, to National Revenue, in 1927. The unofficial motto of Customs and Excise was "The Revenue [always spelled with a capital R] must be protected." Early collectors had to swear on the Bible before a judge 4 times a year that they had turned in all of their quarterly collections. On the Klondike Trail in 1897, the customs officer set up a tent beside Tagish Lake and waded out to the passing prospectors' boats to collect duty on any American goods. Sometimes the revenue was not properly protected. During prohibition, the golden age of liquor smuggling and bootlegging, a 1926 customs scandal temporarily brought down the government (see King-Byng Affair).

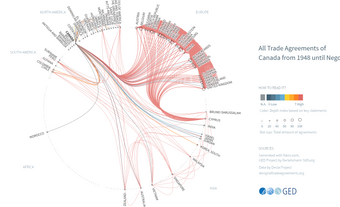

A political battle has long raged in Canada between protectionists and free traders. In 1854, Canada and the US signed a reciprocity treaty (free trade in 50 items). The US abrogated the agreement in 1866, and it was not until 1935 that the 2 countries extended most-favoured-nation treatment to each other in tariff matters. During that time, Canadian voters were occasionally presented with the clear issue of protection versus free trade, and every time free trade lost. High tariff walls were not breached until after WWII through the General Agreement on Tariffs and Trade, signed 18 November 1947. By the 1980s the tariff, with some major exceptions, was generally at the level it held at Confederation. Even the British trade preference, which had been established in 1769, had vanished.

Most customs work used to be conducted at seaports and on the 8893 km frontier with the US. But rail, motor and plane travel has changed that. A staff of some 10 000 operates 650 Customs and Excise locations in Canada, 140 of them on the border, some so remote (eg, Little Gold Creek, YT) that they are abandoned in winter. The cost of collecting the revenue is less than 2% of collections which, in 1985-86, amounted to $19.7 billion. The Finance Department sets taxing laws, including the tariff, while Customs and Excise administers them. These include narcotics, pornographic materials, firearms, diseased plants and "dumped" foreign goods that injure Canadian industry and employment. On 29 April 1999, the Canada Customs and Revenue Agency Act received royal assent. The act created the Canada Customs and Revenue Agency, which aims to provide more efficient service by operating outside of the traditional federal government department structure and allowing for the co-ordination of federal and provincial tax administration.

Share on Facebook

Share on Facebook Share on X

Share on X Share by Email

Share by Email Share on Google Classroom

Share on Google Classroom