Article

Caisse populaire

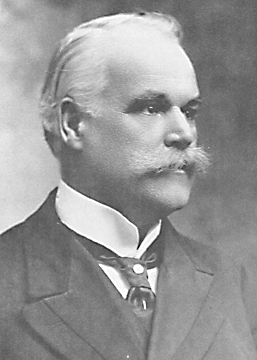

The caisse populaire was established in 1900 as a co-operative savings and loan company with nonfixed capital and limited liability in Lévis, Québec, by Alphonse DESJARDINS, a journalist and French-language stenographer in the House of Commons.