Operations

There are three principal ways the BoC fulfills its functions: interest rates, money supply and moral suasion.

Interest Rates

Interest rates are the cost of holding money. Interest is either earned by the lender or paid by the borrower and determines how much in loans can be afforded by individuals and businesses. Interest rates are in large part determined by the BoC because it is the principle lender of money to chartered banks and other lenders (see Credit Unions). The interest rate charged to the country’s banks for borrowing from the BoC is called the bank rate. This bank rate can be changed by the BoC at any time. Changes to the bank rate are passed on by the chartered banks and other lenders to individual and business borrowers in the rates they are charged to borrow. For example, if the bank rate is decreased by the BoC, chartered banks can lower the interest rate they charge their borrowers, who then tend to borrow more. As a result, economic activity picks up. If the BoC increases the bank rate, the chartered banks charge more for loans, and individuals tend to borrow less.

Interest Rates also influence the Canadian dollar exchange rate. Generally, if the bank rate is increased, more foreign investors wish to purchase Canadian investments, thereby driving up the demand for the Canadian dollar and raising its value relative to other currencies, and vice versa (see Foreign Investment).

Money Supply

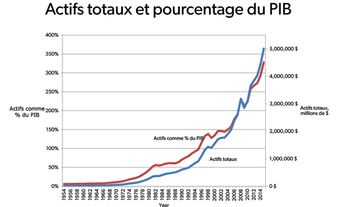

The BoC can change the supply of printed money and credit in the economy. To increase the money supply, the BoC buys federal government bonds from individuals and investors in the marketplace. This increased supply of money can be used to buy more goods and services, thereby increasing economic activity. The increased economic activity can cause prices to rise, which is called inflation (see Consumer Price Index). This process also works in reverse, and the fall in prices is called deflation. The BoC regularly publishes statistics detailing the supply of money in the economy (see Monetary Policy).

The BoC is responsible for the design, production and distribution of Canadian banknotes. The design, production and distribution of coins is the responsibility of the Royal Canadian Mint, a crown corporation.

Moral Suasion

As a manager of the banking industry, the BoC can put pressure on the chartered banks to adjust their banking policies. For example, in the mid-1950s, the BoC was concerned about the significant increase in consumer borrowing to purchase new hard goods (e.g., washing machines, televisions and cars) and its effect on inflation. In order to slow down inflation, the BoC pressured the banks to tighten lending to consumers and finance companies. More recently, the BoC has expressed concern to the banks about over-heating housing prices and household debt levels in the country (see Real Estate in Canada). This type of pressure is called moral suasion and it is accomplished through both public and private means, in which the BoC persuades the financial industry to move in a certain direction. The BoC publishes extensive economic research to back up its policies.

History of the Bank of Canada

Canada did not always have a central bank. As the Canadian financial system developed in the 19th century, and before any significant banking crisis arose, a central bank was not deemed necessary. Instead, the largest bank in the country, the Bank of Montreal, acted as the federal government’s unofficial bank. To supervise the banks, force change when needed, and encourage the banks to limit their risk-taking and to operate prudently, the federal government instituted 10-year review periods in the Bank Act (enacted in 1871). The Act governed the banks’ operations and the re-chartering of the individual banks (revised to every five years in 1992). Each bank issued its own paper money, or currency, that was exchangeable between the banks.

Under the Constitution Act, 1867, only the federal government could charter banks (see Chartered Banks). This centralized control meant that provincial governments could not interfere with money creation to suit their own regional needs or political biases (see Regional Economics). Banks could be national financial institutions from the very beginning, and this diversified the overall risk in the banking industry by allowing the banks to spread their loan risk geographically and across different industry sectors.

After Confederation, the Bank Act stipulated that one half of a chartered bank’s reserves must be held in federal government bonds, called Dominion notes. This meant that the federal government could retain some control over the supply of money, since Dominion notes were used as security for the paper money issued by each chartered bank.

In the case of bank failure during these early days, the Bank of Montreal was generally expected to lead the industry’s efforts to minimize the overall effects on the industry and solve the problem. In 1900, the Canadian Bankers Association (the CBA), an industry association of the chartered banks, was officially incorporated and given the right by the federal government to assess any prospective banker seeking a bank charter, thereby allowing the industry to regulate itself. This lead to the creation of the first centralized clearing system for the currencies of the banks under the supervision of the CBA.

Pressure for a Central Bank

The absence of a central bank had important consequences during the 1920s and thereafter. In 1923, the Bank Act was up for revision, and public hearings began. Under pressure from the CBA, the new Bank Act was presented and passed with little change. This occurred just before the collapse of the Home Bank of Canada and financial troubles in several other banks in the same year. Public outcry was immediate, particularly by farmers and working-class Canadians who not only lost the bulk of their deposits but also lost a source of credit with the collapse of the Home Bank. Pressure grew significantly for a central bank to monitor and regulate the banking system and formalize national monetary policy with respect to interest rates and money supply and to guarantee a lender-of-last-resort policy should any other bank fail.

DID YOU KNOW?

A lender of last resort is an institution, usually a central bank such as the Bank of Canada, that offers loans to banks and other financial institutions that are experiencing financial difficulty.

Public pressure grew so intense that in 1924 the federal government established the office of Inspector of Banks to provide financial oversight of the chartered banks, a move endorsed by the CBA. However, the government did not create a central bank.

Between 1926 and 1929, the federal government began backing Dominion notes with the promise of paying gold when redeemed, a policy that marked the country’s adoption of the gold standard. This meant that money supply would be tied to gold reserves held by the government. Because gold was in fixed supply, this made inflation management more challenging for the government, causing further displeasure.

Creation of the Bank of Canada

Public pressure for the creation of a central bank increased during the Great Depression, particularly among suffering farmers. In response, the Conservative government of Prime Minister R. B. Bennett established a Royal Commission on Banking and Currency in 1933 — known as the MacMillan Commission. As recommended in the commission’s final report, the Bank of Canada Act was passed in 1934, and the Bank of Canada opened in 1935.

The BoC was privately owned at first, but became majority owned by the federal government in 1936 and fully nationalized in 1938. The first governor of the BoC was Graham Towers, a former management executive with the Royal Bank of Canada.

The BoC became the official clearing house for all of Canada’s chartered banks (taking over this role from the CBA). All chartered banks were required to reduce their bank currency gradually over time and to replace it with a single, national currency: the Canadian dollar. This change of control in the issuing of currency was intended to appease populist demand (principally by farmers) to expand the money supply, and hence credit.

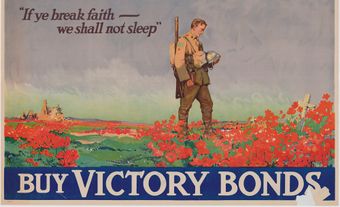

Immediately after the creation of the BoC and during the Second World War the federal government, through the BoC, increased money supply in the financial system to finance the increased production of wartime material. It did so by borrowing from the banking system through federal government bond issues managed by the BoC (see Canada Savings Bonds).

The Coyne Affair

Eventually, a conflict developed between the manner in which the BoC wanted to control inflation and economic growth and the manner preferred by the federal government. This occurred in the mid 1950s, when the BoC wanted to tighten credit in order to reduce inflation. At the same time, the Liberal government of Prime Minister Louis St-Laurent wanted to increase money supply and loans to increase demand and reduce unemployment. This period coincided with a change in management at the Bank of Canada, when James Coyne succeeded Graham Towers as governor in 1955, and the election the Progressive Conservative government of John Diefenbaker in 1957.

The developing “Coyne Affair” centred around a lack of clarity on the relationship between the federal government and the Bank of Canada, and which party ultimately decided on monetary policy.

Coyne was often publicly critical of federal government policy and took a strict policy of fighting inflation by raising interest rates, which alienated some politicians, academics and the public. In 1960, public and corporate outrage followed, culminating in a letter from 29 academic economists to the Finance Minister expressing their lack of confidence in the management of the Bank of Canada. In 1961, the Diefenbaker government asked Coyne to resign, which he refused, and then moved to fire him by passing a bill declaring his position vacant. However, Coyne submitted his resignation shortly after the Senate rejected the bill.

The relationship between the federal government and the BoC was resolved through negotiation when Louis Rasminsky became governor of the BoC in 1961. Going forward, the BoC would be given independence from the federal government in determining monetary policy. In 1967, changes to the Bank of Canada Act affirmed the BoC’s control of day-to-day monetary policy but state that overall policy objectives are set by government.

Continuing Operations

The BoC has set several different policy goals during its operations, each based on the changing economic environment in Canada and globally. During the 1950s and 1960s, the BoC maintained a fixed exchange rate with the United States dollar in order to improve trade with that country (see International Trade). This policy was abandoned in 1970 because the BoC found it untenable to maintain high interest rates and tight money growth when it was causing so much short-term capital inflow to the country, putting upward pressure on the Canadian dollar. The bank began to issue more money to reduce the value of the Canadian dollar, but this in turn increased demand for goods, leading to higher prices and inflation.

The Bank of Canada announced in 1975 that it would introduce a new policy of targeting money supply growth in its efforts to better manage inflation. This became more difficult once the chartered banks introduced new banking innovations that increased the turnover of money being spent in the economy (called the velocity of money). In 1982, the Bank of Canada announced it was abandoning growth targets of money supply and moving to the control of interest rates as a means to fight inflation. John Crow became governor of the Bank of Canada in 1987 and forcefully reiterated the point that the number one long term policy goal of the monetary authority would be price stability achieved through interest rate management.

As inflation continued to rise, the bank announced in 1991 that it would begin setting targets for inflation as its major policy goal. The target rate of inflation would initially be set at 3 per cent but would decline to 2 per cent before the end of the decade. This has remained the policy of the BoC since that time.

Current Challenges

In 2015, the Bank of Canada laid out a plan detailing how it would respond to future economic crises caused by circumstances similar to the financial crisis of 2008. The particular concern of the BoC is the potential challenges from non-banks, such as mutual funds, exchange traded funds, illiquid bond holdings, hedge funds and others. For example, what response is required by the monetary authorities should a mutual fund be unable to meet a massive onslaught of redemption requests in a short period of time out of its small cash position?

Digital Currency

The introduction of new technology to the financial system also poses a challenge to the BoC. The bank revealed in 2016 that it was developing the CAD-coin as a digital version of the Canadian dollar, a move in response to the rise in popularity of bitcoin and other blockchain-based digital currencies. The initiative will involve issuing, transferring and settling the central bank’s monetary assets by way of a computerized ledger rather than by way of printed dollars. Research and experiments have been ongoing since 2016. Bank participants in this new initiative include Royal Bank of Canada, CIBC and TD Bank Group; institutional partners include Payments Canada and TMX Group.

Governors of the Bank of Canada

|

Governor |

Term |

|

1934–54 |

|

|

1955–61 |

|

|

1961–73 |

|

|

1973–87 |

|

|

1987–94 |

|

|

1994–2001 |

|

|

2001–08 |

|

|

2008–13 |

|

|

Stephen Poloz |

2013–2020 |

|

Tiff Macklem |

2020-Present |

Share on Facebook

Share on Facebook Share on X

Share on X Share by Email

Share by Email Share on Google Classroom

Share on Google Classroom