The Canadian Imperial Bank of Commerce, commonly known as CIBC, is the fifth largest chartered bank in Canada. It was created through the 1961 merger of two Ontario-based banks, the Canadian Bank of Commerce and the Imperial Bank of Canada — the largest merger of two chartered banks in Canada’s history. Today, CIBC operates its business in Canada and abroad through three divisions: retail and business banking, wealth management, and capital markets. CIBC is a public company that trades on the Toronto Stock Exchange and the New York Stock Exchange under the symbol CM. In 2022, CIBC registered $21.83 billion in revenue and $6.24 billion in net income and held $943.60 billion in assets. The bank employs approximately 50,427 people, who serve 13 million clients around the world.

Early History

Of the two banks that eventually merged to form CIBC, the Canadian Bank of Commerce was created first, formed by businessman and philanthropist William McMaster in 1867. After taking over the troubled Gore Bank in 1869 (based in Hamilton, Ontario), it became the largest bank based in Ontario with 24 branches by 1874. This included its Montréal branch, which opened in 1870 and was the first branch to be located outside of Ontario. McMaster’s background in international trading made the bank an expert in currency trading, with correspondent banking relationships in London, New York, and elsewhere.

The second of the banks, the Imperial Bank of Canada, was formed in 1874 by Henry Stark Howland, a former vice-president of the Canadian Bank of Commerce. Its first branch outside of Ontario opened in Winnipeg in 1880, part of the bank’s westward expansion. Further expansion west occurred in 1886 when they opened in Calgary — the first chartered bank branch to open in that city.

With the rapid growth of Canada, both banks grew their branch network, depositors, and business loans. The Canadian Bank of Commerce was greatly assisted in this growth when it appointed George Cox as its president in 1890. Cox often integrated the business of the bank into that of his other financial interests, including Canada Life, Imperial Life, Central Canada Loan and Savings, National Trust, A.E. Ames and Company, and Dominion Securities. This integration ensured the Canadian Bank of Commerce became a leader in business lending at the time.

In 1901, the Canadian Bank of Commerce acquired the Bank of British Columbia and its 11 branches, followed by the Bank of Halifax in 1903 and the Merchants Bank of Prince Edward Island in 1906. It followed this by merging with the Eastern Townships Bank in 1912 (based in Sherbrooke, Québec) adding some 100 offices across Canada.

First World War

The First World War had a particular impact on the Canadian Bank of Commerce. Through his various financial entities — including the Canadian Bank of Commerce — bank president George Cox had financed the aggressive expansion of the Canadian Northern Railway by issuing bonds. The outbreak of war negatively impacted the rail industry in Canada and this in turn affected the huge debt-load of the country’s railways. There was considerable concern about the impact of this on the Canadian Bank of Commerce. In response, the Government of Canada began the process of nationalizing the Canadian Northern railway (as well as the Grand Trunk, Intercolonial and National Transcontinental) to form Canadian National Railway in 1919, thereby buying out shareholders (including the bank) and assuming their debt obligations. (See also Railway History.)

Interwar Years

Post-war, industrial growth in Canada ensured both banks would prosper. The Canadian Bank of Commerce maintained a strategy of growing by acquisition when it bought the most successful private bank in Canada at the time, Alloway and Champion Bank of Winnipeg, in 1919. It then purchased the Bank of Hamilton and its 145 branches in 1924, followed by the Standard Bank and its 243 branches in 1928. In contrast, the Imperial Bank of Canada grew its business on its own through branch expansion across the country, and therefore remained a much smaller bank.

One of the headline-grabbing business events of the period was when the Canadian Bank of Commerce, National Trust and others took over the British Empire Steel Corporation in Sydney, Nova Scotia after the company and its constituent companies defaulted on their loan payments to their creditors. The take-over came after labour conflicts occurred in the 1920s. The creditors reorganized the company as Dominion Steel and Coal Corporation.

With the onset of the Great Depression, banking business in Canada slowed considerably. However, in a show of stability, the Canadian Bank of Commerce began construction on its new 34-storey Toronto head office. Opened in 1931, it was the tallest building in the British Commonwealth until 1962.

Mid-20th Century

Both the Canadian Bank of Commerce and the Imperial bank of Canada participated in the government financing of the Second World War by selling Victory Bonds to their customers. As Canada’s economy recovered after the war, both banks resumed growing.

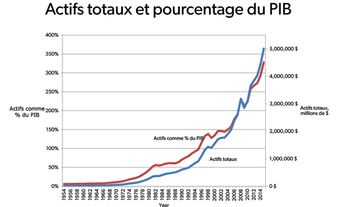

This growth slowed for all banks in the 1950s because of increasing competition from other financial institutions in Canada. Chartered banks’ share of the country’s total financial assets declined from 42 per cent in 1950 to 32 per cent in 1960.

The Imperial Bank of Canada countered this slower growth environment by merging with the smaller Barclays Bank of Canada in 1956. Then, in a move to avoid a foreign takeover itself, the president of the Imperial Bank of Canada approached the Canadian Bank of Commerce about merging. When completed in 1961, the merger represented the largest between two chartered banks in Canada’s history. The new Canadian Imperial Bank of Commerce (CIBC) became the second largest chartered bank in the country with an approximate 25 per cent market share.

All banks in Canada were aided by changes to the Bank Act, first in 1954 and then in 1967. The first set of changes allowed banks to issue mortgage loans for the first time while the second removed the 6 per cent interest rate ceiling they could charge on loans. In 1963, CIBC established Kinross Mortgage Corporation to issue and manage its growing mortgage loan portfolio.

CIBC was particularly challenged by bad corporate loans made during the inflationary period of the late 1970s (see Inflation in Canada). Some of the bank’s large corporate clients struggled to manage their debt as interest rates rose. For example, two particular clients of the bank — Massey-Ferguson and Dome Petroleum — had borrowed substantial amounts of money and struggled to pay the interest on these debts. The losses to the bank were significant.

When the Toronto Blue Jays baseball team was founded in 1977, CIBC became a 10 per cent investor in the team. CIBC was the official bank to the Blue Jays until it sold its ownership stake in 2000.

Late 20th Century – Early 2000s

In 1987, the federal and Ontario governments amended their legislation to allow banks to take ownership positions in stock brokerage firms (see Stock and Bond Markets). CIBC responded to this change by buying a 65 per cent stake in one of Canada’s oldest and largest stock brokerage firms, Wood Gundy (established in 1905) in June 1988 for $190 million. The organization was renamed CIBC Wood Gundy in 1994 and would form the core of the bank’s capital markets division.

CIBC acquired ownership of Merrill Lynch Canada in 1990 and merged it into its Wood Gundy subsidiary. This made Wood Gundy the largest stock brokerage firm in Canada.

The bank made its first large foray into asset management when it purchased a 55 per cent stake in Montréal-based TAL Investment Counsel in 1994. It purchased the remaining ownership stake in 2001 and renamed the operation CIBC Asset Management. Today, this arm of the bank manages its mutual fund, private client, and institutional assets.

In 1997, the grocery store Loblaw Companies Ltd. established a joint venture with CIBC to create President’s Choice Financial — a low-cost, direct banking division of CIBC. Banking transactions would be performed online, by telephone, or at ATMs and staffed kiosks located in the grocery stores. This successful new venture represented the introduction of branchless internet banking in Canada. In 2017, Loblaw left the partnership, and CIBC created Simplii Financial, an online banking brand that absorbed more than two million PC Financial accounts.

CIBC partnered with US-based Mellon Bank in 1996 to form CIBC Mellon, offering financial asset servicing to corporate and institutional clients in Canada. CIBC Mellon remains one of the top institutional asset servicing organizations in Canada.

To grow its presence in the US investment banking business, CIBC purchased the New York-based brokerage firm Oppenheimer & Co. in 1997. This operation was merged into CIBC World Markets.

In 1998, the Royal Bank of Canada and Bank of Montreal shocked everyone when they announced their intention to merge. As a competitive response, three months later Toronto-Dominion Bank and CIBC announced their intention to merge should the federal government give approval. In December 1998 the Minister of Finance declared both mergers void because they wouldn’t be in the best interests of Canadians — the creation of two large banks would limit competition and increase banking risk ( see Banking in Canada).

CIBC Wood Gundy maintained its position as the largest investment brokerage firm in the country by number of brokers when it, once again, bought the Canadian retail operations of US-owned firm Merrill Lynch Canada for an estimated $409 million in 2001 (CIBC had bought Merrill Lynch’s Canadian operations in 1990, following which Merrill Lynch re-entered the Canadian market in 1998 when it bought Midland Walwyn Inc.).

Around the same time, the bank moved executives from CIBC World Markets into the management ranks of the bank. John Hunkin, head of CIBC Corporate and Investment Banking and CIBC World Markets, was appointed chairman and chief executive officer. The bank began to aggressively expand its corporate lending and financing activity through its CIBC World Markets, particularly in the United States. This strategy severely impaired the bank’s business when several of its notable US clients ran into financial difficulties. The first to do so was Enron Corporation when it was revealed in 2001 that the entire company was fraudulently stating its financial position. Some investors sued CIBC, claiming the bank should have caught the fraud earlier. The Enron fraud would end up costing CIBC US$2.4 billion in a 2005 legal settlement. This crisis was immediately followed by the 2002 bankruptcy of telecommunications firm Global Crossing, another company that had obtained funding for its growth from CIBC. When Global Crossing collapsed, it was the fourth largest bankruptcy in US history.

To help stabilize operations, CIBC issued additional shares to the public and streamlined its operations. Over time, Hong-Kong based billionaire Li Ka-Shing became the largest single shareholder in the bank until he sold his 4.9 per cent ownership stake in 2005 for $1.2 billion.

In 2002 CIBC considered merging with the large Canadian insurance company Manulife Financial. These conversations didn’t go far, based on the assumption the federal government wouldn’t approve the deal in the same way they hadn’t approved CIBC’s proposal to merge with the Toronto-Dominion Bank in 1998. Unlike some of its competitor chartered banks, CIBC has not entered into the insurance market either by way of acquisition or by establishing its own subsidiary company.

In a defensive move, the bank began retreating from its aggressive US investment banking strategy. It wanted to focus on retail banking in an effort to reduce the bank’s overall operating risk. In 2007, it sold its ownership stake in New York-based brokerage firm Oppenheimer & Co.

Current Operations

As the bank stabilized, it looked to other stable business areas to grow. In 2010, CIBC acquired New York based Citigroup’s Canadian MasterCard credit card portfolio for $2.1 billion. In 2011, the bank acquired a 41 per cent interest in US-based asset management company American Century Investments and its US$112 billion under management. However, CIBC subsequently sold the stake in 2015 — though the transaction generated about US$150 million profit for the bank, it left investors wondering what strategy it had for growing the wealth management segment of its business.

In 2014, CIBC completed the US$210 million purchase of Atlantic Trust, a wealth management firm operating in 12 US cities and catering to high-net-worth individuals, foundations and endowments. This aided the bank’s goal of growing wealth management to 15 per cent of the bank’s overall earnings.

In 2016, CIBC unveiled a new banking growth strategy when it announced its expansion into US banking with a US$3.8 billion deal to buy Chicago-based PrivateBancorp. This transaction added a 24-branch operation in 12 states with US$17.7 billion of assets. This new foray into international banking is intended to diversify CIBC’s financial exposure and reduce its operating risk, to the extent US earnings would now double to 10 per cent of the bank’s total earnings with a future goal of growing this to 25 per cent. The following year, CIBC rebranded 36 of its American branches and commercial banking offices as CIBC Bank USA.

CIBC established Simplii Financial in 2017, an online banking service it previously operated in partnership with President’s Choice Financial, which decided to leave the banking business. Five years earlier, Scotiabank had acquired ING Direct for $3.1 billion and rebranded it as Tangerine, an online banking service that by 2017 had more than two million clients. The creation of Simplii Financial brought more than two million accounts to CIBC, putting it in competition with Scotiabank’s Tangerine.

On 8 January 2018, CIBC announced the acquisition of Wellington Financial, a Toronto-based venture capital lender with offices in New York and California. Established in 2000, Wellington Financial invested mainly in mid- to later-stage companies in the technology sector that were past their start-up phase. Wellington CEO Mark McQueen was named executive managing director of CIBC Innovation Banking, a new division launched by the bank. CIBC Innovation Banking provides strategic advice and funding to tech sector clients.

Share on Facebook

Share on Facebook Share on X

Share on X Share by Email

Share by Email Share on Google Classroom

Share on Google Classroom