The Chinese head tax was enacted to restrict immigration after Chinese labour was no longer needed to build the Canadian Pacific Railway. Between 1885 and 1923, Chinese immigrants had to pay a head tax to enter Canada. The tax was levied under the Chinese Immigration Act (1885). It was the first legislation in Canadian history to exclude immigration on the basis of ethnic background. With few exceptions, Chinese people had to pay at least $50 to come to Canada. The tax was later raised to $100, then to $500. During the 38 years the tax was in effect, around 82,000 Chinese immigrants paid nearly $23 million in tax. The head tax was removed with the passing of the Chinese Immigration Act in 1923. Also known as the Chinese Exclusion Act, it banned all Chinese immigrants until its repeal in 1947. In 2006, the federal government apologized for the head tax and its other racist immigration policies targeting Chinese people.

This is the full-length entry about the Chinese Head Tax. For a plain-language summary, please see Chinese Head Tax in Canada (Plain-Language Summary).

Background

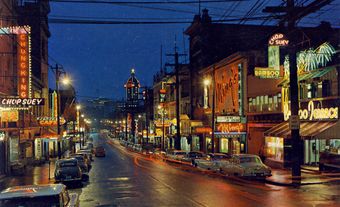

The first major wave of Chinese immigration began with the Fraser River gold rush of 1858. From 1881 to 1885, more than 15,000 Chinese labourers came to work on the construction of the Canadian Pacific Railway.

Prime Minister John A. Macdonald acknowledged the necessity of Chinese labour. When the government of British Columbia tried to ban Chinese immigration in 1882, Macdonald said in the House of Commons, “either you must have this labour or you can’t have the railway.” (See The “Other” Last Spike.) But as construction of the railway neared completion, Macdonald willingly yielded to prejudiced and discriminatory politicians, trade unionists and public opinion. In 1884, he appointed the Royal Commission on Chinese Immigration to investigate the restriction of Chinese immigrants. (See also Royal Commissions.)

Commissioners Sir Joseph-Adolphe Chapleau and John Hamilton Gray heard testimonies from 51 witnesses. Most of them gave negative reports. The only testimonials from Chinese people were provided by two consular officials from San Francisco, California. Other nations’ immigration policies were looked at by the commission, including the American Chinese Exclusion Act (1882). Chinese immigration laws in New Zealand (1881) and Victoria, Australia (1855), both levied a £10 poll tax on Chinese immigrants.

In 1885, the commissioners concluded that there was little evidence to support the negative claims against the Chinese. They also found that Chinese immigration was in fact beneficial to the development of British Columbia. Still, their findings were aligned with most of the witnesses. Instead of exclusion, Chapleau and Gray called for legislation to restrict Chinese immigration — specifically, a $10 entry fee for Chinese immigrants. Money raised by such taxation was to be spent on a health inspector to examine all Chinese passengers for diseases. The tax would also pay for a joint tribunal; it would closely monitor and control the lives of Chinese people in Canada.

The Canadian government passed the Chinese Immigration Act on 20 July 1885. It included a $50 head tax. This amount was intended to be an obstacle for entry to Canada. The Royal Commission found that the average Chinese labourer earned $300 a year and saved a modest $43 after living expenses.

By 1902, it was clear that the head tax had not slowed Chinese immigration — even after it doubled from $50 to $100. A second inquiry, the Royal Commission on Chinese and Japanese Immigration, suggested the head tax be increased to $500. This fee was equal to about two years’ salary or the purchase of two homes. It was instituted by Parliament in 1903.

Chinese Immigration Act

Under the Chinese Immigration Act, Chinese migrants had to pay a head tax of $50 to come to Canada. (Diplomats, government representatives, tourists, merchants, scientists and students were exempt.) The Chinese were the only group that had to pay the head tax. (See Immigration Policy.)

The Act contained other restrictions. Ships were permitted only one Chinese passenger for every 50 tons of the ship’s total weight — compared with one person per 2 tons for ships carrying European immigrants. Entrance was denied to Chinese immigrants with leprosy or infectious diseases and to any known sex workers. All Chinese residents, whether naturalized or Canadian-born, had to pay a fee of $0.50 to register with local authorities.

There were many amendments to the Act. In 1887, Chinese women married to non-Chinese men were exempted from the head tax, as were any Chinese people travelling through Canada by railway en route to another country. Under an 1892 amendment, any Chinese person who temporarily left the country had to register with immigration authorities. In 1908, students were no longer exempted from the head tax. In 1917, immigration officials gained the right to arrest any Chinese person believed to be in Canada illegally. In 1921, Chinese people who left Canada for more than two years or left without registering, had to pay the head tax upon his or her return.

The head tax was in effect for 38 years (1885–1923). Over that time, around 82,000 Chinese immigrants paid nearly $23 million in tax. In 1906, Newfoundland, still a British colony, passed the Act Respecting the Immigration of Chinese Persons. Commonly known as the Newfoundland Chinese Immigration Act, it introduced a $300 head tax. Newfoundland’s head tax remained in effect until Newfoundland and Labrador joined Confederation in 1949.

Despite these anti-Chinese immigration laws, the Chinese population in Canada increased from 4,383 to 39,587 between 1881 and 1921. In response, the federal government resorted to a drastic solution. On 1 July 1923, the head tax was abolished and the Chinese Immigration Act, also known as the Chinese Exclusion Act, was passed. It banned all Chinese immigrants, save for a handful of merchants, diplomats and students. While Canadians celebrated Dominion Day (now Canada Day) on 1 July, the Chinese communities in Canada saw it as “Humiliation Day” and boycotted festivities. The Act was in effect for 24 years, from 1923 until its repeal in 1947.

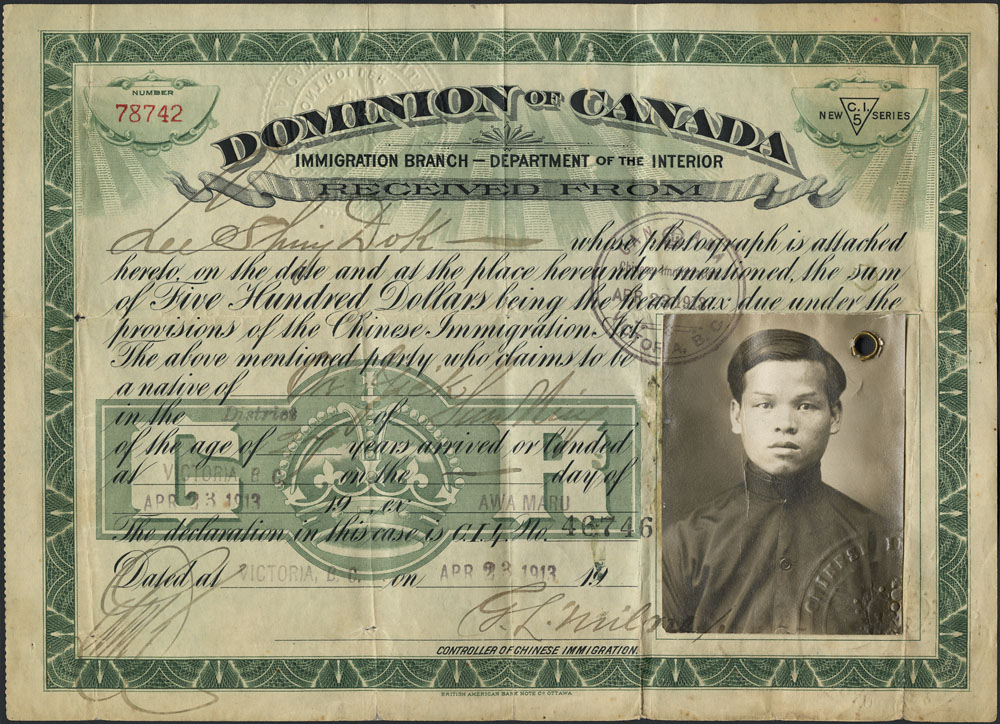

Head Tax Certificates

From 1885 until 1949, the year Newfoundland ended its head tax, Chinese immigrants were issued certificates as proof of head-tax payment. These documents were officially classified as C.I.5 certificates — C.I. meaning “Chinese Immigration.” They listed names, ports and dates of arrival, as well as amounts paid. Anyone travelling to China needed an official stamp on the certificate to re-enter Canada. Otherwise, returning travellers had to pay the head tax. The format of the certificate was changed at least four times. A photograph was added in 1912 to curb illegal immigration.

Other C.I. certificates were also used. For instance, the C.I.6 certificate was issued to Chinese immigrants who had arrived before the head tax. Chinese people, born overseas or in Canada, needed the C.I.9 certificate for temporary travel outside of Canada.

General Registers of Chinese Immigration

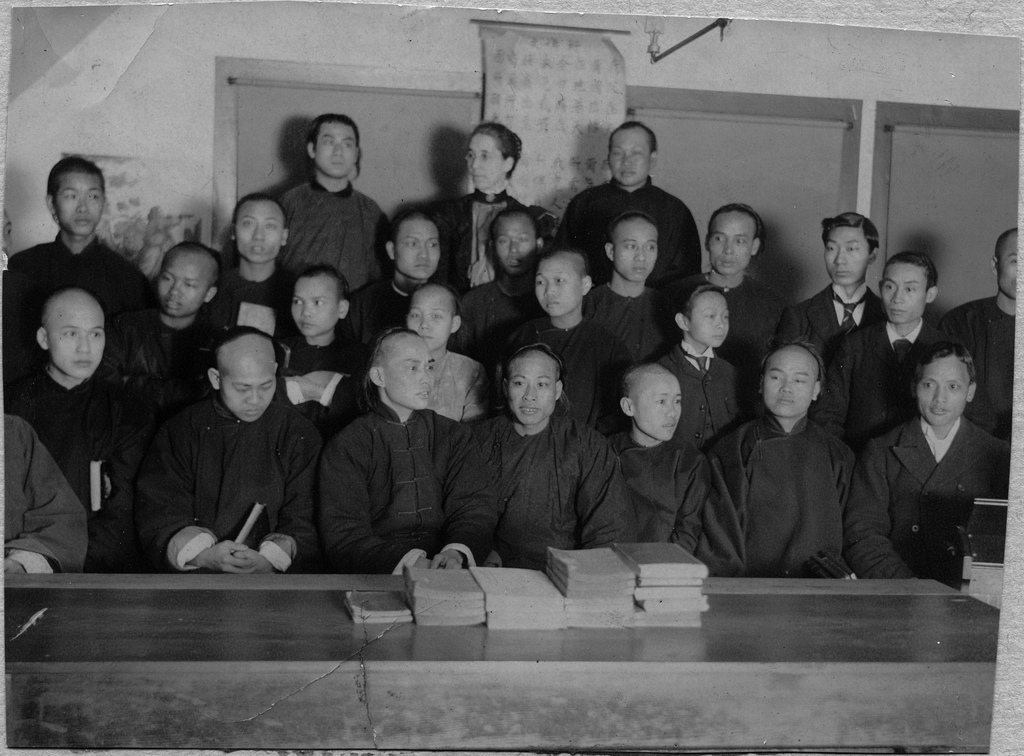

Details of all Chinese people arriving from 1885 until 1949 were handwritten in large ledger books. There were 19 columns of information, including name; port or place where registered; date of registration; amount of head tax; sex; age; place of birth; profession or occupation; name of vessel or train upon arrival; and physical marks. No other immigrant group was documented to this degree.

The Newfoundland Register of Arrivals and Outward Registrations had two lists: one for records of entry; the other for departures. Chinese immigrants were issued NF 63 certificates from 1910 to 1949. Anyone leaving Newfoundland temporarily or permanently was issued a C.I.9 certificate and was recorded on the list for departures.

The Port of New Westminster Register of Chinese Immigration, 1887–1908, is the only port register known to have survived. It lists Chinese immigrants who paid the head tax at the port of New Westminster, British Columbia.

Impact on Chinese Community Life

Institutional racism was perpetuated by the Chinese Immigration Act and more than 100 other policies. They denied Chinese people the right to vote; to practice law or medicine; to hold public office; to seek employment on public works; or to own crown land, among other restrictions. This prejudice and discrimination was echoed by politicians, the public and the press. As a result, the Chinese community suffered low social standing. But the most devastating consequence of the Act was its impact on family life.

The majority of Chinese people in Canada were men whose wives and children remained in China. Europeans were encouraged to come to Canada with offers of free land. (See also Dominion Lands Act; History of Settlement in the Canadian Prairies.) But the head tax made it financially impossible (save for a few instances) to bring families from China. Other significant roadblocks were the cost of passage and the loss of cultural traditions. Women were expected to stay behind to look after children, parents and extended family members, as well as ancestral burial sites. In 1911, the ratio of Chinese men to women in Canada was 28 to 1. This was the highest gender imbalance among any ethnic group in Canada until the end of the Second World War.

These men lived in what became known as a bachelor society. Their meager savings were sent regularly to their families in China, who endured decades of poverty, starvation, banditry and civil wars. The head tax did not deter Chinese immigration, but it did stunt the growth of the Chinese population in Canada.

Apology and Redress

After the repeal of the Chinese Immigration Act in 1947, the Chinese Canadian community began calling on the federal government for redress (correction and compensation) for its anti-immigration policies. In 1983, a simple act by two elderly head-tax payers sparked a decades-long campaign for action. Dak Leon Mark and Shack Yee asked their local member of Parliament (MP) for a refund of their $500 head tax payments. Their request was denied.

Two national organizations — the Chinese Canadian National Council (CCNC) and later the National Congress of Chinese Canadians (NCCC) — pressured the government to acknowledge and address its history of anti-Chinese immigration policy. Both organizations’ objectives were the same, but their demands were different. The NCCC wanted an apology and funds for an educational foundation. The CCNC sought an acknowledgement in Parliament, an apology and symbolic financial compensation. It lobbied on behalf of 4,000 head-tax payers, their spouses and descendants.

Other organizations, protests and events rallied Chinese Canadians across the country. In 1988, the Japanese Canadian Redress Agreement was signed by Prime Minister Brian Mulroney. The Agreement acknowledged and redressed the injustices suffered by Japanese Canadians during the Second World War. ( See Internment of Japanese Canadians.) Years later, the Prime Minister attempted to settle other redress claims. However, these symbolic offers were rejected by the Chinese, Italian and Ukrainian Canadian communities. (See also: Internment in Canada; Ukrainian Internment in Canada.)

A class-action lawsuit, filed in 2000 by Shack Jang Mak (a head-tax payer) and the widow and son of head-tax payer Guang Foo Lee, was struck down in the Ontario Superior Court. In 2004, in response to a submission filed by Chinese Canadian organizations, Doudou Diène, the United Nations special rapporteur on contemporary forms of racism, racial discrimination, xenophobia and related intolerance, recommended that Canada redress the head tax.

That same year, MP Inky Mark introduced private member’s Bill C-333. It expressed sorrow for the head tax and other immigration restrictions from 1885 to 1947. The bill opened negotiations with the NCCC for the development of public education initiatives. However, the CCNC, head-tax payers and their families were excluded from the discussions.

The Liberal government under Prime Minister Paul Martin dissolved in late 2005. As a result, Bill C-333 did not become law. In the months leading up to the 2006 federal election, the head tax was a significant campaign issue. Martin made a personal apology on Fairchild Radio (which airs Chinese-language programming). However, it was not an official apology, as expected by the Chinese community. The Conservative Party pledged to redress the head tax if elected.

On 22 June 2006, newly elected Prime Minister Stephen Harper apologized in the House of Commons to head-tax payers, their families and the Chinese Canadian community. He pledged “symbolic payments to living head-tax payers and living spouses of deceased payers.” A commitment was made to establish “funds to help finance community projects aimed at acknowledging the impact of past wartime measures and immigration restrictions on the Chinese Canadian community and other ethnocultural communities.”

Six days later, Newfoundland and Labrador premier Danny Williams apologized for the $300 head tax imposed by the former Dominion of Newfoundland. The City of New Westminster apologized in 2010 for its past exclusionary policies. In 2014, BC premier Christy Clark apologized for the province’s more than 100 anti-Chinese laws and policies of the past.

Fewer than 50 head-tax payers were among the 785 people who received payments of $20,000 from the federal government in 2009. Many descendants of head-tax payers continue the redress campaign for family members excluded from the 2006 settlement.

Significance

The head tax was enacted to restrict immigration after Chinese labour was no longer needed to build the Canadian Pacific Railway. British Columbia not only benefited by receiving 40 per cent of the country’s $23 million in head-tax revenues, but it also placated its anti-Chinese politicians and citizens in the process. The paradox was that the discriminatory legislation to keep out the Chinese in fact increased their levels of immigration. Ultimately, the head tax was the final step towards outright exclusion.

Legacy

In 2008, the Government of Canada’s Community Historical Recognition Program was established through consultation with Chinese, Italian, Ukrainian, Jewish and Indo-Canadian communities. Its goal was to educate Canadians about the hardships resulting from immigration restrictions and wartime measures. A $5 million fund was allocated for projects about Chinese immigration restrictions. This led to the creation of 33 art, music, film, literature, theatre, oral history and photography projects. They include Lost Years: A People’s Struggle for Justice; The Ties That Bind; and Newfoundland Head Tax and the Chinese Community.

See also: Racial Segregation of Asian Canadians; Asian Heritage in Canada; Celebrating Asian Heritage in Canada.

Share on Facebook

Share on Facebook Share on X

Share on X Share by Email

Share by Email Share on Google Classroom

Share on Google Classroom